Certainly, here are the top five reasons why getting insurance today is a wise decision:

- Financial Protection in Uncertain Times: Insurance provides a safety net for unexpected events and emergencies. Whether it’s health insurance for medical expenses, auto insurance for accidents, or home insurance for property damage, having coverage can prevent financial devastation during challenging times.

- Peace of Mind: Knowing that you and your loved ones are financially protected in case of an unforeseen event can bring peace of mind. Insurance ensures that you won’t have to bear the full financial burden of unexpected accidents, illnesses, or disasters.

- Legal and Regulatory Requirements: Some forms of insurance are legally required. For example, auto insurance is mandatory in many places to protect you and others on the road. Failing to have the required insurance can result in legal penalties and fines.

- Asset Protection: Insurance helps safeguard your assets and investments. For homeowners, insurance protects your house and belongings from damage or theft. Likewise, life insurance can provide for your family’s financial well-being in the event of your passing.

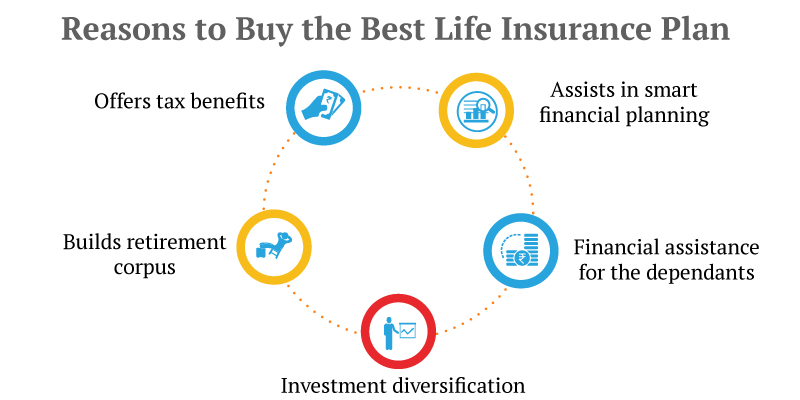

- Long-Term Financial Planning: Many insurance policies, such as life insurance and retirement annuities, serve as long-term financial planning tools. They can help you accumulate wealth, save for retirement, or leave a legacy for your heirs.

In conclusion, insurance is a crucial component of financial stability and risk management. It offers protection, peace of mind, and legal compliance, making it essential for individuals and families to consider their insurance needs and take steps to secure coverage today.