Introduction

Filing an insurance claim is a crucial step in accessing the benefits and coverage you’ve been paying for. Whether it’s for health, auto, home, or any other type of insurance, understanding the claims process and knowing how to navigate it can make a significant difference in the outcome. In this article, we will explore the steps involved in filing an insurance claim, tips for a smooth process, and how to handle common challenges that may arise.

Step 1: Review Your Policy

Before you need to file a claim, familiarize yourself with your insurance policy. Understanding the terms, conditions, coverage limits, and exclusions will help you know what to expect during the claims process. It’s essential to know the specifics of your policy, including deductibles, copayments, and any waiting periods.

Step 2: Notify Your Insurance Company

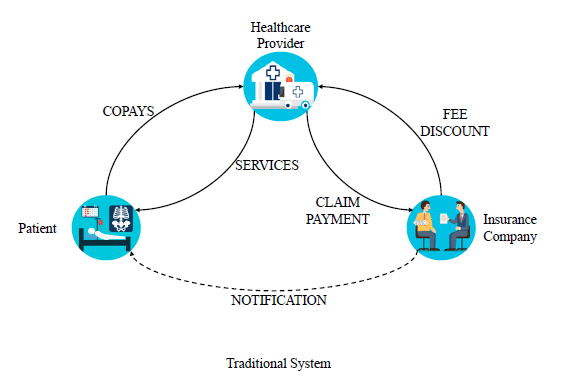

Promptly report the incident or event that requires a claim to your insurance company. Most insurers have specific timeframes for reporting claims, so it’s crucial not to delay. Contact your insurance company by phone or through their online portal, and provide all the necessary information, including the date, time, location, and details of the incident.

Step 3: Gather Documentation

To support your claim, collect all relevant documents, such as:

- Photos or videos of the damage or incident.

- Police reports (in the case of accidents or theft).

- Medical records and bills (for health insurance claims).

- Repair estimates (for property damage claims).

- Receipts for expenses related to the claim.

Accurate and thorough documentation is critical in ensuring your claim is processed smoothly.

Step 4: Complete Claim Forms

Your insurance company may require you to fill out specific claim forms. These forms typically ask for details about the incident, your policy information, and supporting documentation. Be truthful and provide as much detail as possible to expedite the process.

Step 5: Cooperate with Adjusters

In many cases, an insurance adjuster will assess the damage or situation to determine the validity of your claim and the extent of coverage. Be cooperative and provide access to the necessary areas and information. It’s important to be honest and transparent during this process.

Step 6: Follow Up

Stay in regular contact with your insurance company to check the status of your claim. Ask for reference numbers or claim IDs to track the progress. Keep detailed records of all communications with your insurer, including dates, times, and the names of representatives you spoke with.

Step 7: Review Settlement Offers

Once your insurance company evaluates your claim, they will provide a settlement offer. Review it carefully and compare it to your policy coverage. If you believe the offer is insufficient, negotiate with your insurer. You can provide additional documentation or consult with an attorney if necessary.

Common Challenges and How to Handle Them

- Claim Denials: If your claim is denied, review your policy and the denial letter for specific reasons. If you believe the denial is unjust, appeal the decision and provide additional evidence to support your claim.

- Delays: Insurance claims can sometimes take longer than expected. Maintain regular communication with your insurer, inquire about the reasons for delays, and request an estimated timeline for resolution.

- Disputed Amounts: If you and your insurer disagree on the settlement amount, seek resolution through negotiation or, if necessary, arbitration or legal action.

- Canceled Policies: If your policy is canceled or non-renewed after filing a claim, inquire about the reasons and explore alternative insurance options.

Conclusion

Filing an insurance claim can be a challenging process, but understanding the steps involved, maintaining open communication with your insurance company, and diligently providing documentation can help ensure a smoother experience. It’s crucial to know your rights, review your policy, and seek assistance from professionals or legal resources if needed to resolve disputes or challenges. Ultimately, the goal is to obtain the coverage and benefits you are entitled to under your insurance policy.